Featured Scientist

Yu-Min Lian, Ph.D.

Assistant Professor

Department of Business Administration

Education & Academic Qualifications

Ph.D. in Banking and Financial Markets, National Chengchi University, Taiwan.

Research Interests

Derivative Financial Products, Financial Engineering, Quantitative Finance, Risk Management

Time-inhomogeneity and jump risks in derivative financial products

Professor Yu-Min Lian research interests are mainly on the area of financial engineering and quantitative finance. The subjects of my previous studies include option pricing theory and the application of financial engineering in financial markets. Some of the completed papers were published in the SSCI and Scopus Journals, and there are several papers submitted to be published in the foreign professional Journals.

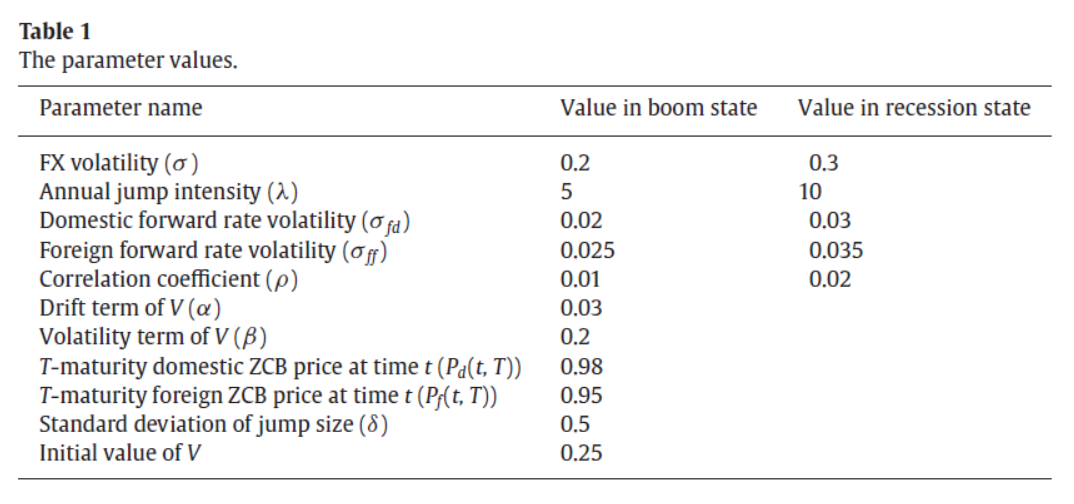

The topics included within the field of financial engineering are (1) option pricing theory, including theoretical and numerical methods, (2) interest rate models, and (3) the application of option pricing theory, including the exotic products. For the most recent researches, my interests in (1) barrier option pricing under time-inhomogeneity and asymmetrical jump risks, (2) the modeling of credit risks and pricing corporate bonds, (3) the application of state-dependent processes in option pricing, (4) using cojump-diffusion dynamics in accessing optimal portfolios, (5) the joint dynamic modeling and option pricing, and (6) a detailed study about the pricing of virtual currency-linked derivatives, which are useful in theory and in practices.

262 views