Featured Scientist

Yi Ping Liao, Ph. D.

Education background

Ph.D., National Taiwan University, Taiwan

Research interest

Accounting, Cost & Management Accounting, Financial Statement Analysis

Professor Liao, Yi-Ping, graduated from National Taiwan University with a Ph.D. in Accounting. Research interests mainly include the impact of financial accounting reports on the capital market, the economic consequences of accounting and auditing standards, and the policy implications of the liability insurance of compensation committees, directors, and supervisors. Previous works have been published in Accounting Horizons, the Journal of Accounting Auditing and Finance, the Pacific-Basin Financial Journal, the Asia-Pacific Journal of Accounting and Economics, Accounting Review, Contemporary Accounting, NTU Management Review, and other domestic and international journals. In the leisure time, Professor Liao likes reading books and watching films and television. Favorites include Jin Yong, Hayao Miyazaki, Harry Potter, and The Lord of the Rings Series.

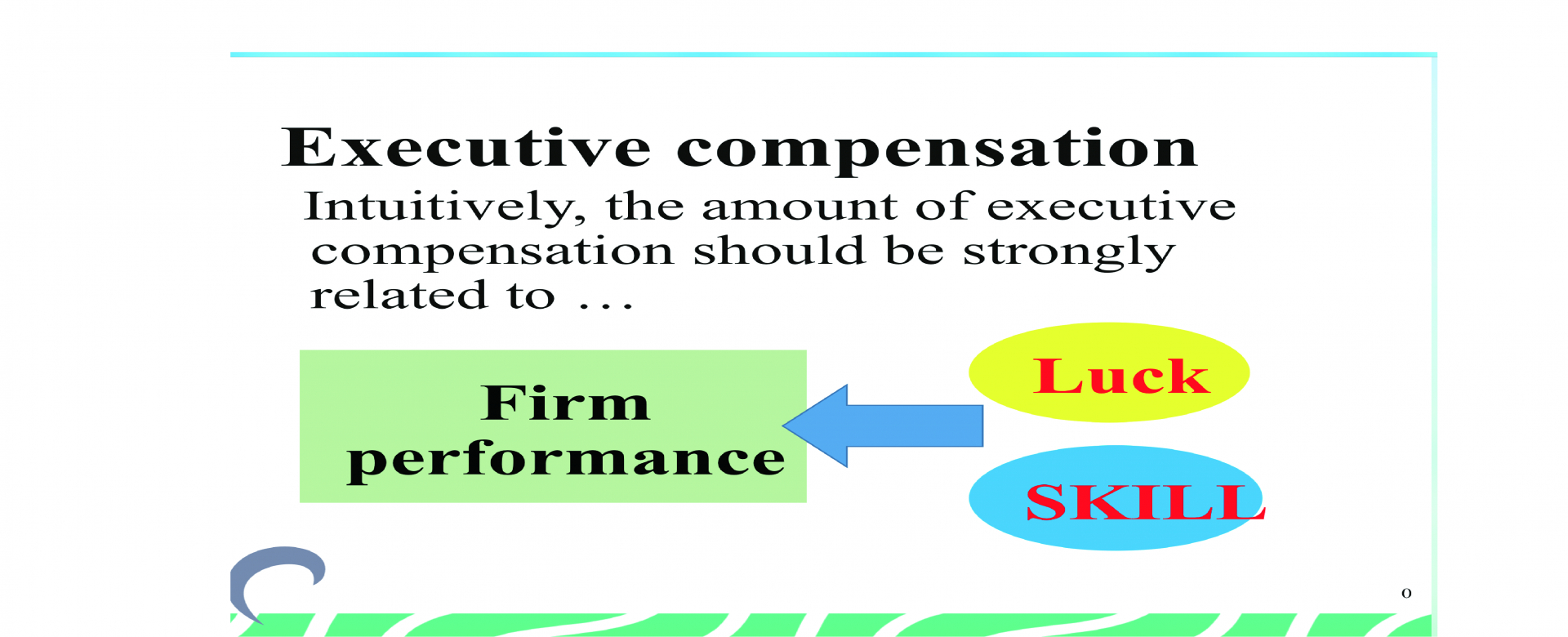

Friendly compensation committees and pay-for-luck asymmetry: Evidence from Taiwan

Linking the compensation of senior managers to company performance is an essential technique for motivation. However, company performance includes a number of elements that are beyond the control of senior managers. If such elements not excluded in the compensation contract, the managers' efforts may not be effectively promoted. Bertrand and Mullainathan (2001) referred to performance beyond the control of senior managers the as "pay-for-luck" compensation. Garvey and Milbourn (2006) found that the degree of decrease in compensation caused by poor luck is usually less than the degree of increase in compensation caused by good luck, which they further refer to as "pay-for-luck asymmetry". This study believes that the compensation committee plays a crucial role in formulating the compensation contract, so the supervision intensity of the compensation committee should affect pay-for-luck asymmetry. This study takes public offering companies in Taiwan as the research object and identifies whether each member of the compensation committee has any of the following social ties with any manager of the company: (1) alumni, (2) academic field, (3) same industry experience, (4) worked at the same time in another company in the past, (5) worked in the company at the same time in the past two years, or (6) has one of the first five ties through other directors. If a member meets two or more of the six ties mentioned above, he/she is regarded as a friendly member. If more than 50% of the members of a particular compensation committee are friendly members, it is considered a friendly compensation committee. The results of regression analysis show that when the compensation committee of the company is friendly to the managers, pay-for-luck asymmetry is more likely, that is, "the degree of reward for managers' compensation when external factors make the company perform better" is greater than "the degree of punishment for managers' compensation when external factors make the company perform poorer." Therefore, a compensation contract formulated by a friendly compensation committee may not be able to encourage managers to exert the level of effort that would maximize benefits to shareholders. This study contributes to the field in various ways. First of all, this study provides empirical evidence that the past literature has not shown, that is, the positive correlation between a friendly compensation committee and pay-for-luck asymmetry. Furthermore, the empirical results of this study show that more than 50% of the sample companies' compensation committees have friendly relations with their managers, indicating that friendly compensation committees are fairly common. This evidence reminds relevant competent authorities to understand that close attention still needs to be paid to any friendships between the compensation committee and the manager even if the formal independence conditions are met. Finally, since the compensation committee is the cornerstone of promoting the efficiency of the compensation contract and prohibiting the appointment of friendly compensation committee members may be practically unfeasible or costly, if the competent authority wants to reduce the negative impact of the friendly compensation committee, other measures need to be considered, like increasing the legal responsibility of the compensation committee or forcing the disclosure of friendly information.

79 views