The Empirical Research of International Finance

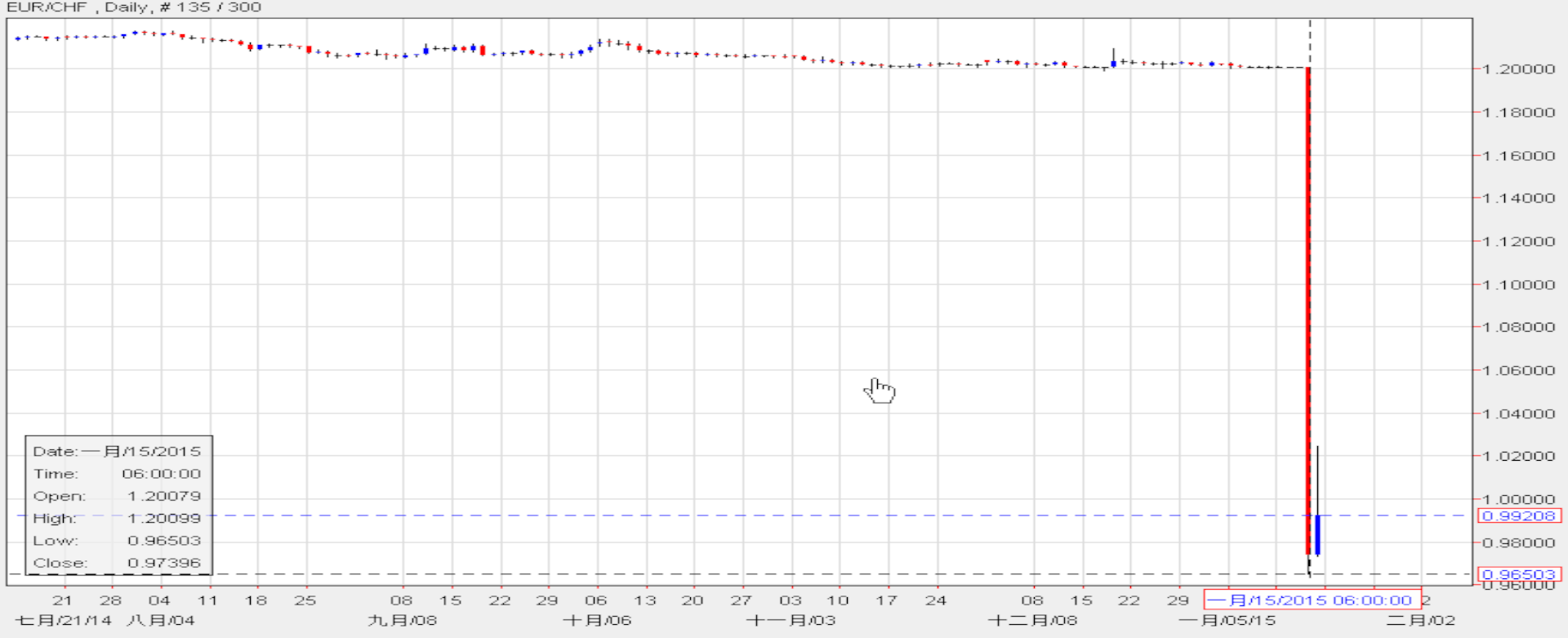

Foreign exchange (FX) is the world largest financial market. The daily trading volume of FX is over 4 trillion US dollars. The FX rate is closely connected with the global political/economic policies/events. In January 15th, when the Swiss National Bank (SNB) suddenly announced that it would no longer hold the Swiss franc at a fixed exchange rate with the euro, the investor who hold a long position in the EUR/CHF margin trade would lose over 1 million NT dollars instantaneously. FX rates is so volatile that it has become an issue not only concerns academia but also industry and government.

The appreciation/depreciation of domestic currency is an indication of the national economic power. It also deeply affects the international trade and policies. Therefore, the research of FX rate has become an important research topic in the international financial field. There have been a huge number of theoretical and empirical research literature.

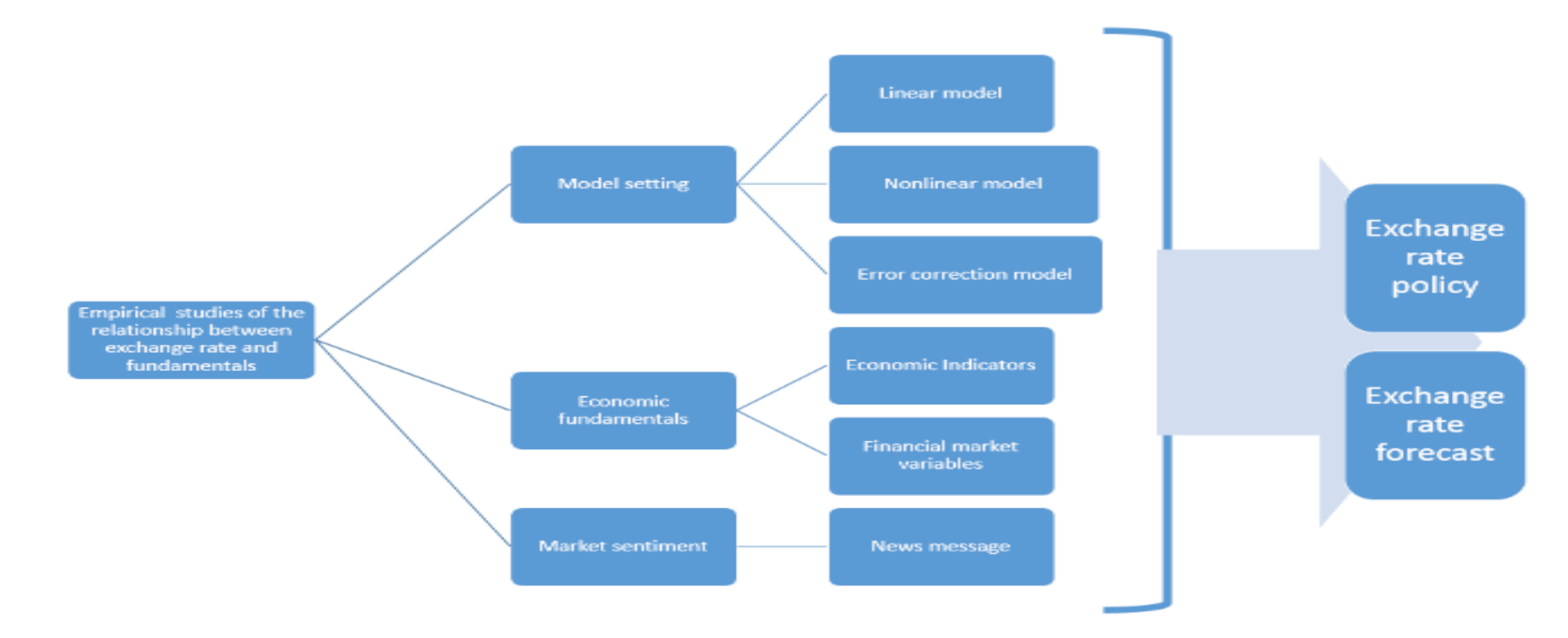

There are various subjects on FX empirical research. They mainly focus on the relationship between economic fundamentals and FX rates. Theoretically, the economic fundamentals can help to explain the fluctuations of FX rates. However, whether the relationship holds is subject to empirical research. If it does not hold, then what is the problem that arises? And, can empirical research might provide new research directions?

This major theme is divided into:

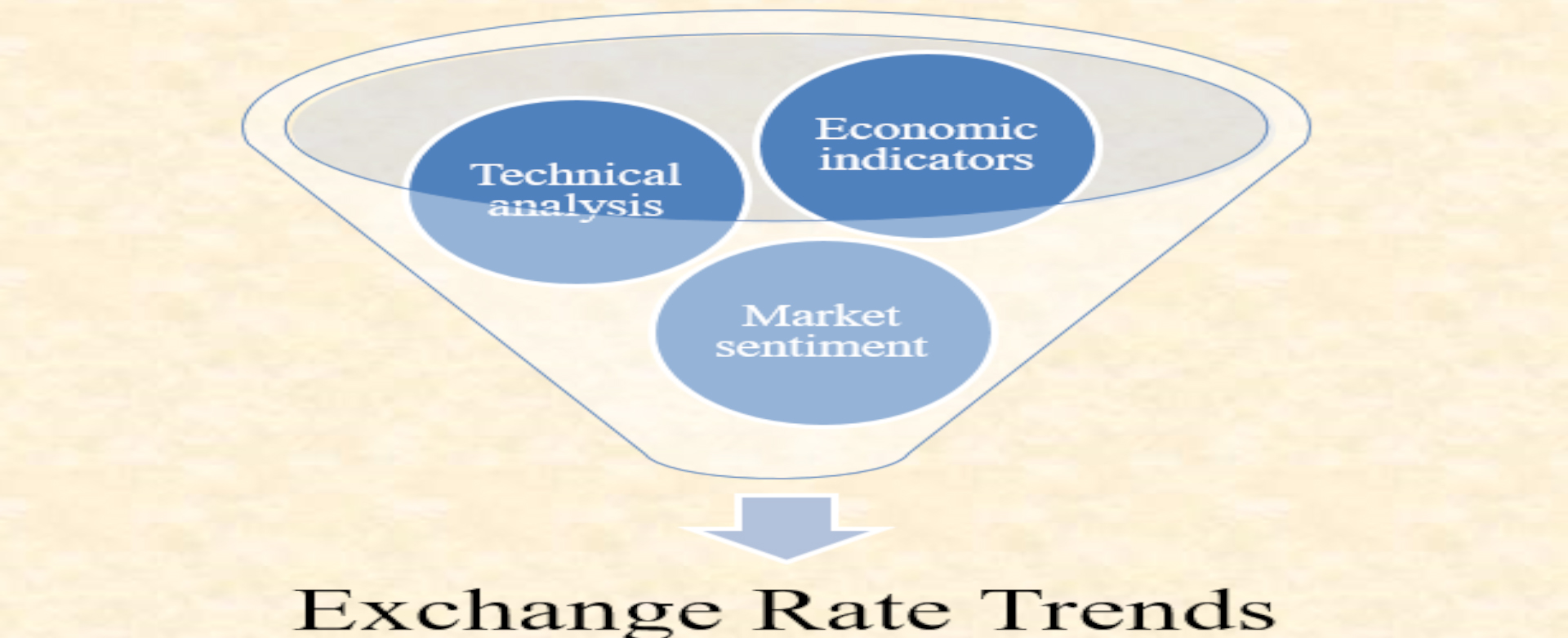

- Research with different model: linear, non-linear, and error correction models will be built depending on static/dynamic or short/long term equilibrium. An appropriate model will fit the FX and make the explanation/forecasting more precise.

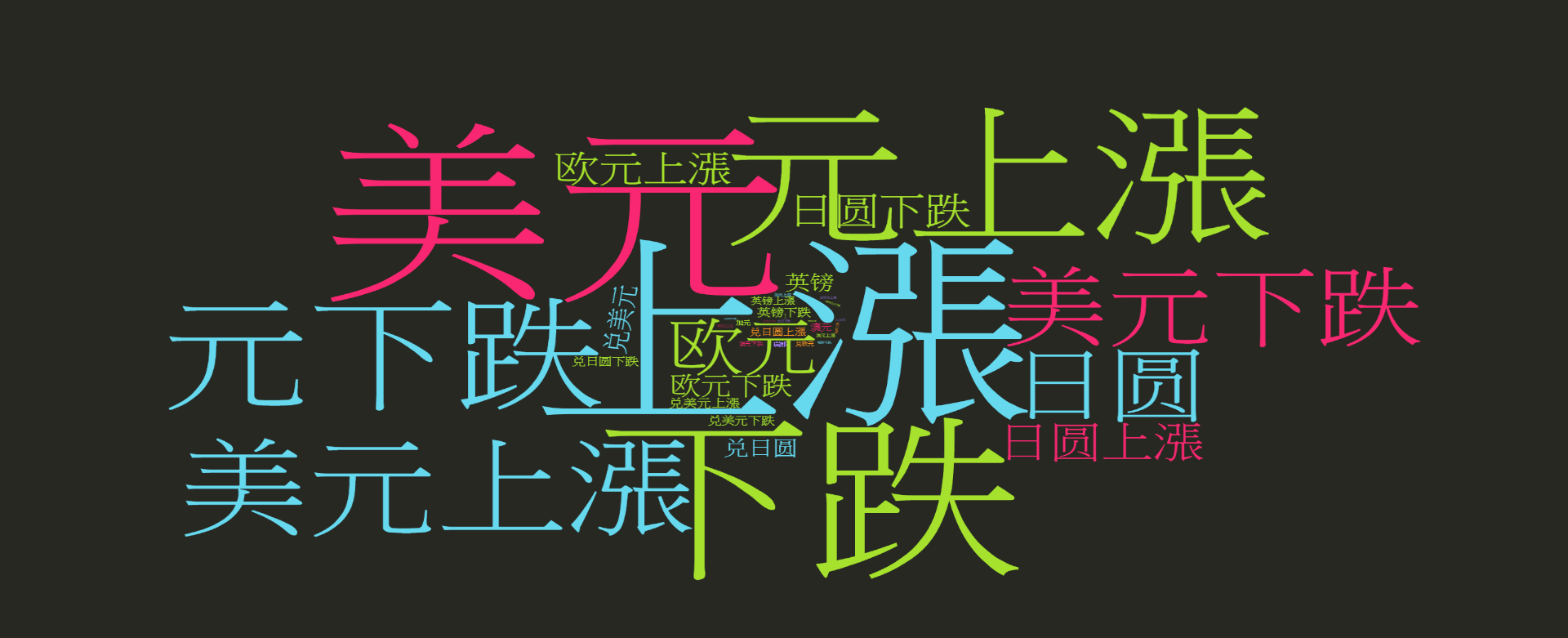

- Fundamentals: There are a lot of research on the factors that affect FX rates. Factors considered ranges from macroeconomic to financial indicators. The development of information technology (such as big data mining) and the mandatory disclosure of financial data make the news and sentimental index an alternative research subject.

Professor Chen's research is mainly focused on FX rates forecast, the factors that affect FX rates, efficiency of FX market, whether the FX rates fluctuate excessively, hypothesis testing on FX rates theories, whether the announcement of macroeconomic indicators reverses the FX rates, whether the excess fluctuation of FX rates is resulted from the deviation from fundamental value, and the FX rates misalignment problems.

In addition, She does other FX rate research analysis. Such as whether the real FX rate is affected by the home bias. She also developed an adjusted Bollinger band technical index to increase the forecasting efficiency and the trading performance.

The research on FX rates is getting more and more important under the globalization trend. The research subjects evolve along with the economic environment. It will be an everlasting research interest.

74 views